How to Strategize Your Business for Schedule-C Taxpayers

How to lower your taxes legally on your Schedule-C for small business owners.

- Utilize a Health Reimbursement Arrangement or Section 105-HRA Plan

Make your spouse an employee and cover them with family coverage health insurance. This is how you, the employer (and spouse) get your coverage.

- Employ Your Teenagers

Hiring someone under the age of 18 may seem risky but the reward can be great for both parties. Besides providing a young individual with what is likely a first job, your are shifting taxable income to a much smaller tax bracket. Teens can also earn up to the standard deduction without paying any federal income tax. If it is your child and they are under 18, your are also exempt from FICA.

- Employ Your Husband or Wife

Along the same lines as step 1, when you employ a spouse you can give reimbursements for medical expenses instead of paying W-2 wages. This makes medical expenses here a deduction against business income.

- Set Up a Rental Agreement with Your Spouse

When you have a rental agreement you create a Schedule-E which has many benefits and does not give rise to your self-employment taxes. Shifting income from Schedule-C to Schedule-E with a rental agreement with your spouse is a great way to lower taxable income.

- Create a Home Office

When you create a home office space it allows your to deduct some personal expenses for your office space. Examples include utilities, insurance, repairs and more. You can also depreciate a portion of your home as business property.

- Know Your Fringe Benefits

Did you know you can gift employees tax-free benefits if they fall under the de minimis fringe benefit rule? Your business can deduct and gift things like flowers, fruits, books and more and your employees can receive them tax-free.

- Make the Most Out of Your Vehicle

When you have a home office and also a heavy vehicle there are some great tax benefits to be considered. In combination if the home office qualifies as a principal office it increases the business-use percentage of the vehicle. (This is because it eliminates commuting miles)

- Take a Business Trip (Domestic)

When you travel domestically and you spend your time doing business related things you can deduct your transportation expenses on your direct routes to and from business events. You can also deduct your meals and your hotel stays too.

- Take a Business Trip (Foreign)

Did you know so long as you travel less then7 days, if you travel for business outside the US you can deduct 100 of your transportation costs, meals and lodging to your business events? Even if you only work one day!

- Capitalize on Cell Phone Expenses

Provide yourself and employees with a cellphone. Even if it is not for working purposes it is considered a tax-free fringe benefit for employees and 100% deductible on Schedule-C. For you as the business owner, you can deduct the business percentage and depreciate the value of the phone itself.

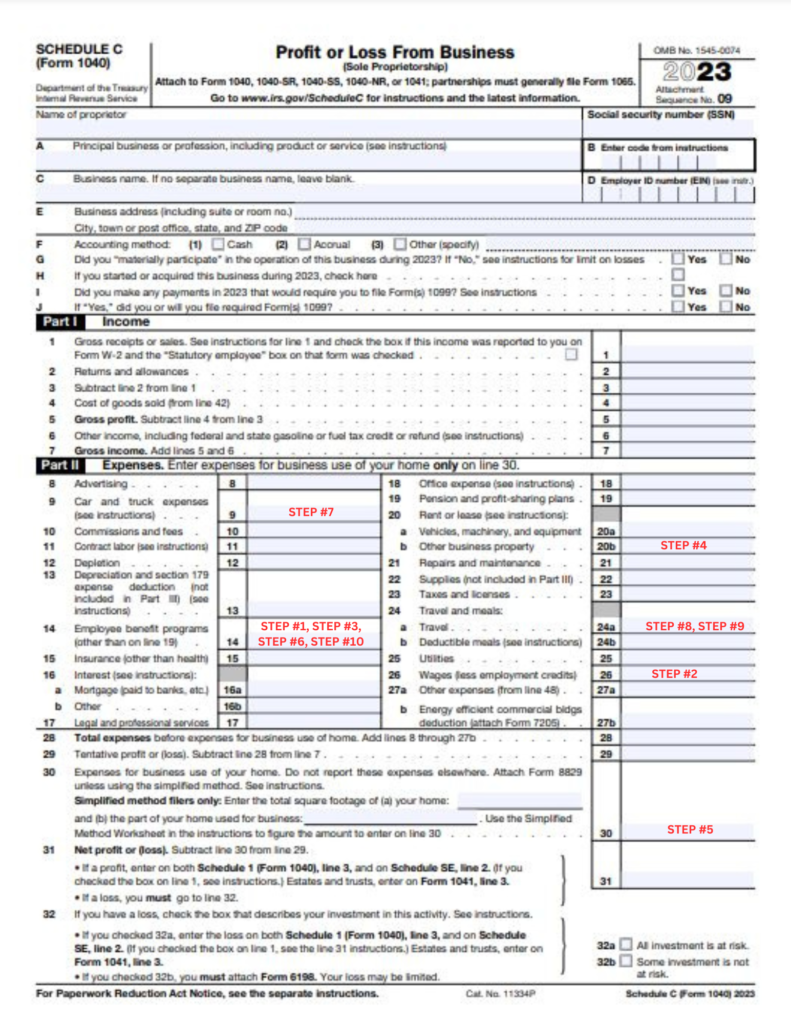

Here is where to find each Step on your Schedule-C Form. Remember doing this on your own without consulting a tax advisor can be tricky. Call Drenen Financial Services at 413-569-0015 for a consultation.