What Are Tax Accountability Plans and Can Drenen Help Determine Your Eligibility?

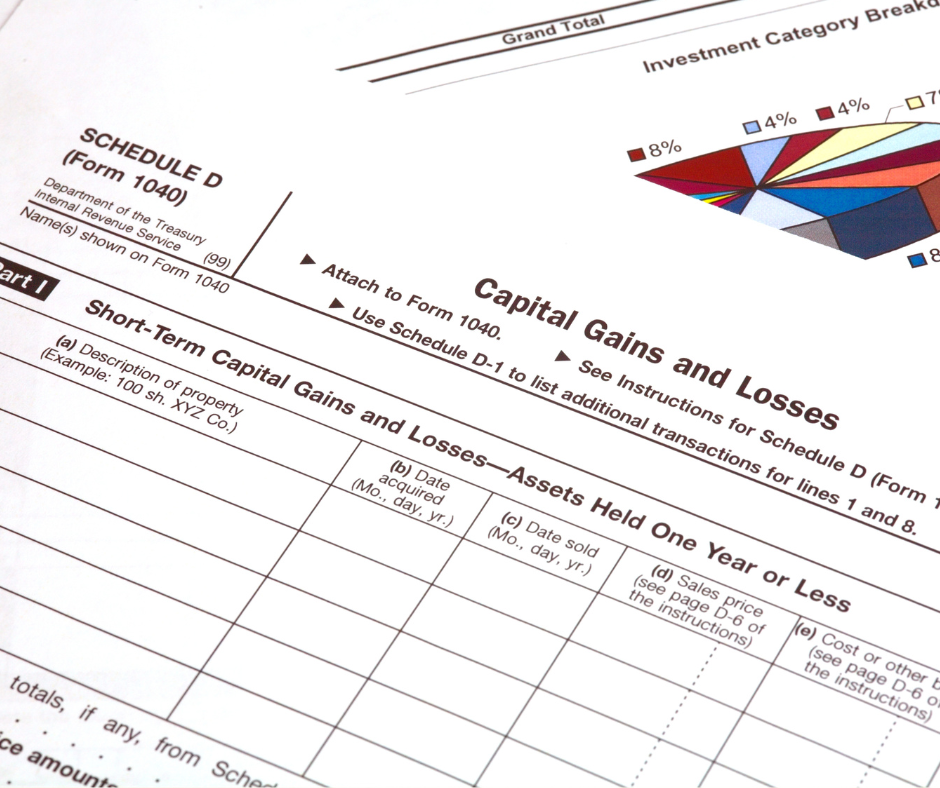

Tax accountability plans, synonymous with tax compliance programs, are structured IRS arrangements designed to assist taxpayers in meeting their obligations efficiently.